How will I know if my bank has refunded my account?.How quickly must my bank handle my claim, and when will my account be refunded?.How do I make a claim under the Check 21 refund procedure?.Does the special refund procedure apply if I receive an image statement with a picture of a substitute check but do not receive the actual substitute check?.If I suffer a loss related to a substitute check I received, can I file a claim with my bank?.What protections do I have if I receive image statements, access pictures of my checks online, or receive an account statement with descriptive information about my canceled checks?.Do I need to use magnetic ink or toner when printing checks?.

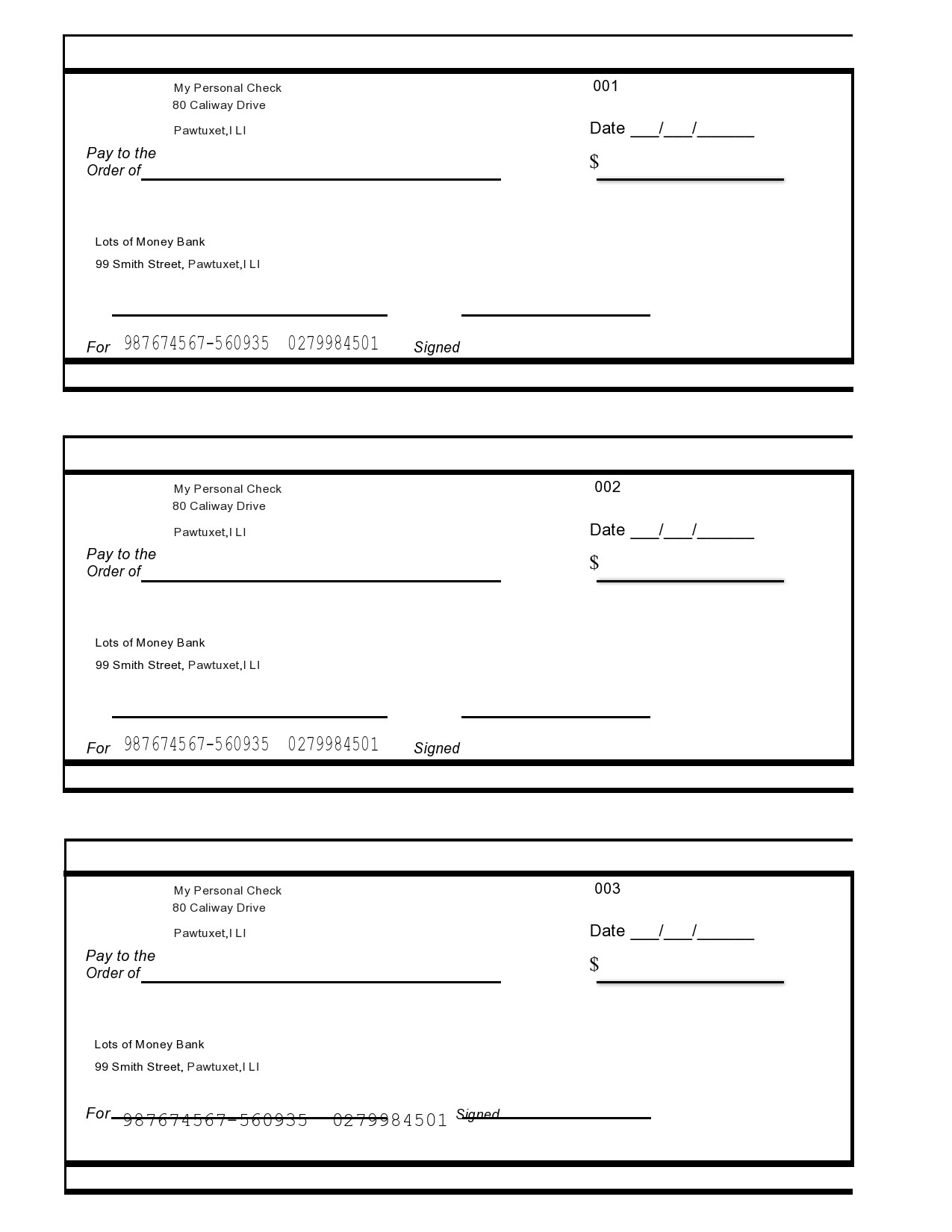

What if I receive a substitute check representing a fraudulent original check?.Can I prevent others from using my original check to create a substitute check?.Can I get my original check if I need it?.Can I still get my canceled checks back?.Is my bank required to tell me about substitute checks?.What should I do if something is wrong with the substitute check that I receive?.Can I demand a substitute check from my bank instead of a copy?.How are image statements different from substitute checks?.Can I use a substitute check as proof of payment?.When is a substitute check legally the same as the original check?.What is the difference between Check 21 and programs that convert checks to electronic payments?.Will Check 21 change how fast my bank must make my check deposits available for withdrawal?.Will Check 21 increase the speed with which checks are cleared between banks?.What changes can I expect when Check 21 goes into effect?.Does Check 21 mean that customers can't get their checks back in their account statements?.How will Check 21 make check processing more efficient?.What is Check 21 and what is its basic purpose?.The Federal Reserve Board has released the final rule to implement Check 21, including the model disclosure language for depository institutions to use in notifying consumers of their rights under the law. The law does not require banks to accept checks in electronic form nor does it require banks to use the new authority granted by the Act to create substitute checks. A substitute check is the legal equivalent of the original check and includes all the information contained on the original check. The law facilitates check truncation by creating a new negotiable instrument called a substitute check, which permits banks to truncate original checks, to process check information electronically, and to deliver substitute checks to banks that want to continue receiving paper checks.

Check 21 is designed to foster innovation in the payments system and to enhance its efficiency by reducing some of the legal impediments to check truncation. The Check Clearing for the 21st Century Act (Check 21) was signed into law on October 28, 2003, and became effective on October 28, 2004.

0 kommentar(er)

0 kommentar(er)